MedMen is selling its dispensary holdings in Arizona — a state it entered a little more than a year ago. It is also selling a factory in Illinois to help the multi-state operator cut costs and shore up cash.

Curated from https://ktvz.com/money/2019/12/31/cannabis-industry-growing-pains-lead-medmen-to-ditch-arizona/

MedMen Enterprises is continuing to slim down following an acquisition binge and industry downturn that left the cannabis retailer’s finances in the red.

MedMen is selling its holdings in Arizona — a state it entered a little more than a year ago. It is also selling a factory in Illinois to help the multi-state operator cut costs and shore up cash.

The restructuring at MedMen comes as some of the largest businesses in cannabis resolve to shed excess weight, narrow their focus, and be less spendthrift.

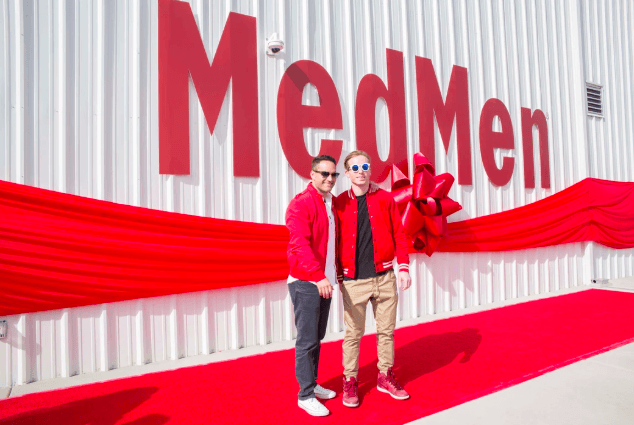

“We are no longer in the land-grab growth phase of this industry,” Adam Bierman, MedMen’s chief executive officer and co-founder, said in an interview with CNN Business.

From 2018 to early 2019, cannabis companies raced to acquire assets and bought up multiple licenses across several US states with the aim of gaining scale. MedMen and others turned to reverse takeovers that landed them on Canadian stock exchanges, and they gained the use of stock as currency.

“When we went public, we went public for one reason and that was to complete the footprint that we were seeking, building the premier cannabis brand with the preeminent footprint,” Bierman said.

In the past six months, the landscape changed dramatically. Cannabis stocks and valuations took nosedives as earnings and returns didn’t match the lofty projections and outsized expectations.

MedMen, like other cannabis businesses, cut its fat.

In recent weeks, MedMen nixed a planned $682 million acquisition of multi-state operator PharmaCann, shed store- and corporate-level workers, and loosened some corporate governance reins. Co-founder Andrew Modlin granted share voting rights for one year to board Chairman Ben Rose, chief investment officer of investor Wicklow Capital.

“In the high-growth phase or life of the business, we were reliant upon the capital markets to fuel that growth,” Bierman said. “In this chapter, we have to rely upon ourselves, our assets and how we choose to monetize those assets.”

Companies like MedMen often didn’t consider what it takes to get a successful business up and running, said Rob E. Hunt, founding partner of Linnaea Holdings, a private equity firm that provides investments and operational expertise to California cannabis firms.

With MedMen, that effect was more pronounced than some of its competitors. MedMen’s M.O. was opening upscale stores in ritzy locales such as Beverly Hills, Las Vegas, Miami Beach and New York’s Fifth Avenue. To continue that look and feel in stores acquired across the nation, came at a price.

“[MedMen’s store design] isn’t a mid-range model,” Hunt said. “This is meant to be a luxury model.”

MedMen plans to continue focusing on markets such as California Nevada, Florida, Illinois, Massachusetts and New York. Being located in prime “Main on Main” retail real estate remains core to MedMen, Bierman said. To focus more on markets such as California, , MedMen had to scale back elsewhere.

“Nothing in Arizona matches that right now,” Bierman said.

Curated from https://ktvz.com/money/2019/12/31/cannabis-industry-growing-pains-lead-medmen-to-ditch-arizona/