BY DR. LLOYD COVENS

2019 MJ Growth to Top $15Bil. Despite RMJ Loss in New York

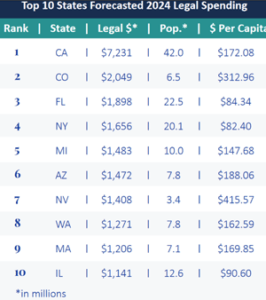

In its’ 7th annual report, “The State of Legal Markets,” BDS Analytics and Arcview Group, project 2019 global cannabis sales will pass $15Bill., growing in 2024 past $30Bil, or a compound growth of 20% per year. The report also predicts the top 10 states who will have the highest grossing consumer demand for both RMJ and MMJ product. California remains number one in that 2024 estimate, despite early post-legalization statewide rules which continue to be plagued by black/gray markets which easily account for two-thirds of all cannabis sales. Here are the top states as projected for total sales of cannabinoid based products (legal cannabis, CBD and FDA-approved CBD medicines).

With Illinois’ passage of a 620-page legislation bill—and the equally important inability for New York to advance a legalization bill – the cannabis industry can be assured of facing a 2020 election year likely to push for RMJ bills in 20 states – either through the legislature – or again showing up on ballots for the November general election. Voter ballot options to support legalized cannabis are certain to appear in Florida, New Jersey, Arizona and Connecticut. RMJ movement through the legislatures will continue in Delaware (likely to have an RMJ bill out of the House), in Maryland, Rhode Island, New Mexico, Hawaii and again in New York.

Hope for passage of a last-minute RMJ bill for New York finally fizzled as lawmakers wanted exact language written in with funding for “negatively-impacted communities” – while Gov. Andrew Cuomo wanted instead to name a commission to oversee spending of an estimated annual tax haul surpassing $700Million per year. Many opposed legislators sought to set up a complex “opt-in” arrangement, where statewide cannabis would remain banned, unless a local city or county brought additional enacting measures to allow the start of RMJ retailers and cultivation.

For anti-pot group SAM (Safe Alternative to Marijuana) who spent barely $10,000 on four billboards, it was a sweet victory in the face of major lobbying dollars spent by Drug Policy Alliance, or the estimated $100,000-plus spent on billboards by WeedMaps. A plan-B bill to bring statewide decriminalization to New York, along with a process for 300,000-plus low-level drug expungements, was pending at press time.

As the session wound up in New York, a short-term scare occurred when an amendment to restrict CBD sales in the state was floated, but then pulled. Longtime MJ advocate, Rep. Diane Savino (D-Staten Island) was able to push improvements to the states’ medical MJ program.

Congress Advances Cannabis Reforms

After a week of favorable committee hearings on cannabis measures covering vets, small businesses and banking— the full U.S. House voted 267 to 165 (June 20) to approve the Blumenauer-McClintock Amendment which protects state level legal cannabis programs and supports key elements of the STATES Act.

The amendment, for the first time, sends a positive signal that Congress wants no interference by the federal government in the activities of state government in their regulation of legal marijuana policies. Another amendment passed earlier, found $5Mil. stripped from the budget of the Drug Enforcement Agency, organized in part by Democrats angry over excessive marijuana targeting.

Vegas Pledges $6.1mil MJ Taxes for Homeless

The Clark County Commission has voted to earmark major MJ-tax funding to help homeless families in metro Las Vegas. The $6.1Mil. was awarded to HopeLink of Southern Nevada, HELP of Southern Nevada and Lutheran Social Services of Nevada and is expected to add 594 beds in mostly short-term rentals. Three years ago, Aurora, Colorado pledged $1.5Mil from cannabis taxation for improving services to that city’s homeless, including opening a “daytime service center” for citizens to shower, clean their clothes, access computers and obtain minor medical treatment.

Acreage Holdings Eyeing Canopy Growth

Cannabis stocks reacted favorably as the majority of stockholders of Acreage Holdings agreed to terms offered in a lock-up (and future acquisition) by Canadian LP giant Canopy Growth Corp. With US federal illegality still in-force, Canopy has agreed to send $300Mil. in cash to the leading US multi-state operator, and an eventual takeover means Acreage is valued at around $3.4Bil.

Canopy Growth would retain the right to buy Acreage should the U.S. legalize marijuana federally or pass the STATES Act. Last week, Canopy Growth sent shareholder a 200-page summary making the case for why they should vote in favor of the future acquisition. CGC has become heavily owned by retail investors with 38 percent of Canopy stock held by insiders, and institutional investors controlling 11.4%.

About 50% is owned by entities that do not have to disclose holdings, which often means retail investors. A small set of Acreage shareholders had vowed to vote against the deal, saying it was undervalued given the major multiples placed on multi-state operators.

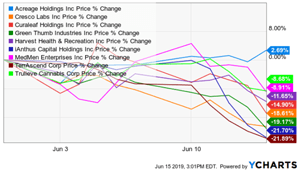

June Swoon

The approval may help turnaround a “June Swoon” experienced by North America’s largest cannabis concerns. Above, the chart from New Cannabis Ventures shows some companies taking a loss of 10 to 18 percent in stock value. NCV founder and lead analyst Alan Brochstein says the market may be concerned with the loosening of company stock floats– and sudden increased U.S. government securities oversight over several pending deals.

In Florida, there are now more than 300,000 MMJ cardholders; for Michigan, there are over 280,000 MMJ cardholders, over 190,000 is Arizona. Tourism sales are also likely to drive major MJ purchases in Nevada, Illinois and Colorado. Not making the cut, despite their US population in the top 10, were anti-cannabis leaders in Texas and Ohio, both conflicted in failing to pass any meaningful MJ progress in 2019. Unlike other prior year reports, the new ArcView/BDS report includes the sales of CBD along with the global sale of legal cannabis. Other items reported:

Investment capital raised by cannabis companies more than quadrupled to $14 billion in 2018, according to Viridian Capital Advisors.

Despite a 55 percent decline in 2018 in New Cannabis Ventures’ Global Cannabis Stock Index, the five largest Canadian licensed producers closed out the first quarter of 2019 at a combined market capitalization of $48 billion.

In Canada, which launched adult-use nationwide October 17, 2018, spending on adult-use cannabis is forecast to grow from $113 million in the partial year of 2018 to almost $4.8 billion by 2024.

–Based in Denver, Dr. Lloyd Covens, DBA is a seasoned cannabis industry journalist and the publisher of West420 NewsWeekly. Writing his doctorate on diffusion of innovations, Covens has been an expert journalist/researcher for 20 years chronicling new technology, global television and renewable energy advancements. He has reported on developments in the cannabis and hemp industry with weekly reports since 2014 covering the western U.S. for legal medical cannabis, recreational sales and hemp production. Covens is also the creator of the annual CO Hemp CBD conference held in Pueblo, Colorado.

–Based in Denver, Dr. Lloyd Covens, DBA is a seasoned cannabis industry journalist and the publisher of West420 NewsWeekly. Writing his doctorate on diffusion of innovations, Covens has been an expert journalist/researcher for 20 years chronicling new technology, global television and renewable energy advancements. He has reported on developments in the cannabis and hemp industry with weekly reports since 2014 covering the western U.S. for legal medical cannabis, recreational sales and hemp production. Covens is also the creator of the annual CO Hemp CBD conference held in Pueblo, Colorado.